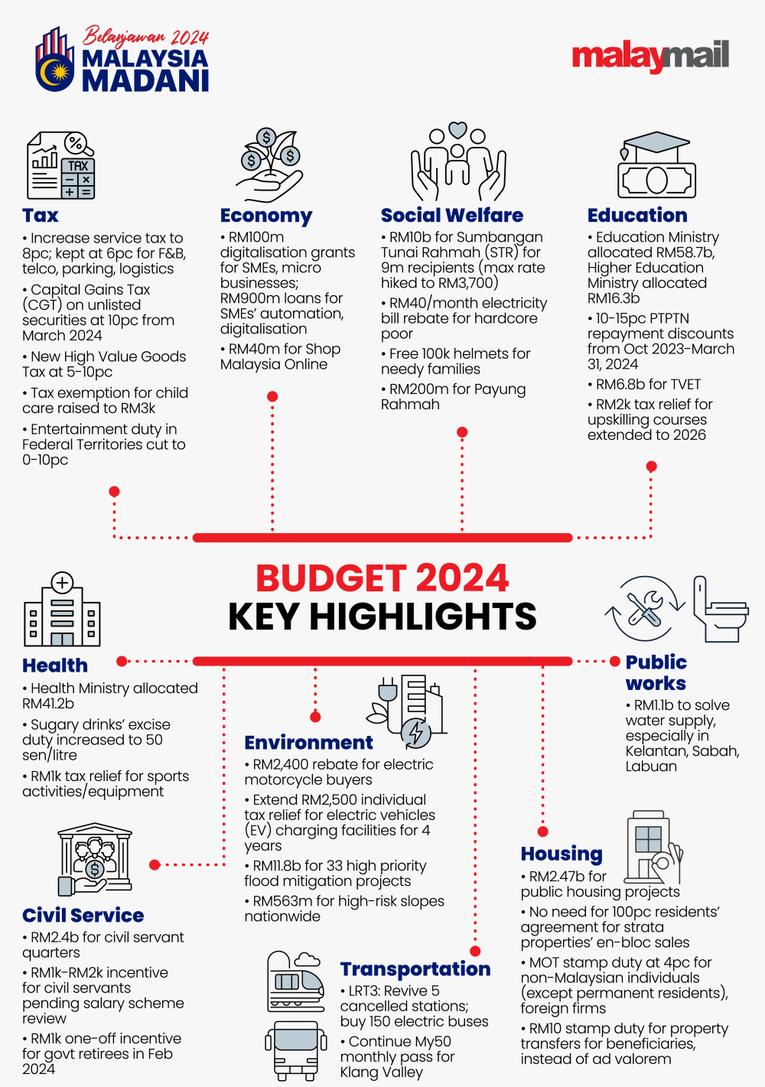

Our in-depth analysis looks at the winners and losers in a wide range of industries, giving you useful information about the economy and the policy consequences. In our most recent blog post, we break down Anwar's Budget 2024 and talk about the important people who come out on top and those who face problems. Malaysia announced a spending plan worth RM393.8 billion. The goal is to lower the country's budget deficit by 2024 and boost investor trust by being more responsible with its money. Prime Minister Anwar Ibrahim said that his government will cut around RM11.5 billion in subsidies as it moves towards focused aid. He also said that the economy will grow by 4% to 5% next year. Take a look at some of the most important wins and losers. Winners 1. Construction Industry Maybank Investment Bank's (Maybank IB) research and economics team is overall positive on the Budget 2024 measures. They said the Higher development allocations and new projects, such as the RM11.8 billion nationwide flood mitigation program and the RM10 billion Penang's first LRT project, are expected to benefit the construction industry the most. Among the many upcoming infrastructure projects planned by the government is the reopening of five previously cancelled stations on the RM4.7 billion light-rail transport LRT3 project. It would also widen the primary interstate route in the country and backed a new RM10 billion light-rail transit for Penang. Companies in the building and engineering industries should benefit from this. 2. Tourism Industry Maybank IB also thinks that the aviation industry will benefit a lot from Budget 2024. This is because more money will be spent to promote Tourism events and boost tourism before Visit Malaysia Year 2026, which was originally supposed to happen in 2025 but was pushed back. 3. Poultry industry Malaysia's poultry business said that prices for chicken and eggs will no longer be capped. Getting rid of subsidies and price controls for chickens is good for poultry companies. It will make cost-pass through mechanisms work better, and market forces like demand and supply will be able to change the average selling price of chickens and eggs. Losers 1. Shopaholics Next year, the Service Tax will go up from 6% to 8%, which will hurt people's banks accounts. A luxury goods tax (LGT) will also be put in place for things like watches and gold. This will not affect services like food and drinks or phone calls, though. Soon, there will be a 10% capital gains tax (CGT) on shares that aren't traded on a stock exchange. Malaysia's tax collection is smaller than Singapore's (12.6% of GDP) and Thailand's (16.4% of GDP), which is why the government is taking these steps. 2. Sugary Beverages Up from 40 sen to 50 sen per litre, the excise charge on sugary pre-mixed drinks has been raised. This price increase is part of a bigger plan to reduce the health risks that come from eating too much sugar. The government will also raise the excise duty on sugary drinks, which may affect beverage makers. So, think twice before you drink that pop with extra sugar. 3. Tobacco Malaysia will also increase its excise duty on tobacco products, as it continues to pursue anti-smoking legislation. Malaysia's tobacco industry faces a challenging landscape. The decision to increase excise duty on tobacco products, part of the country’s ongoing anti-smoking efforts, poses a significant threat to tobacco firms If you would like to invest into the related public listed companies, you may register Direct CDS Account online here.

You also may entitle my services if you have already an Trading Account with M+ Online, I will teach you how if you wish to get these extra Remisier Services.

0 Comments

Leave a Reply. |

Categories

All

|

|

Alternatively, you may WhatsApp me at +60169059789.

|

About MeAbout CompanyM+ OnlineM+ Global |

Why me?M+ Global FAQsBlog |