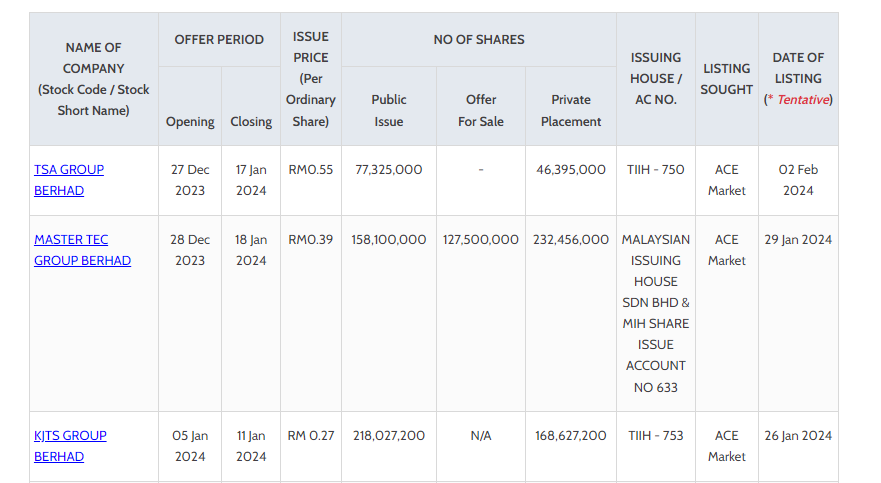

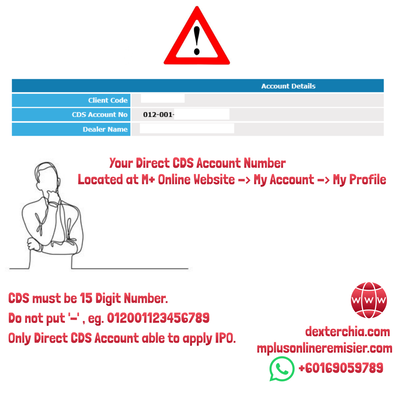

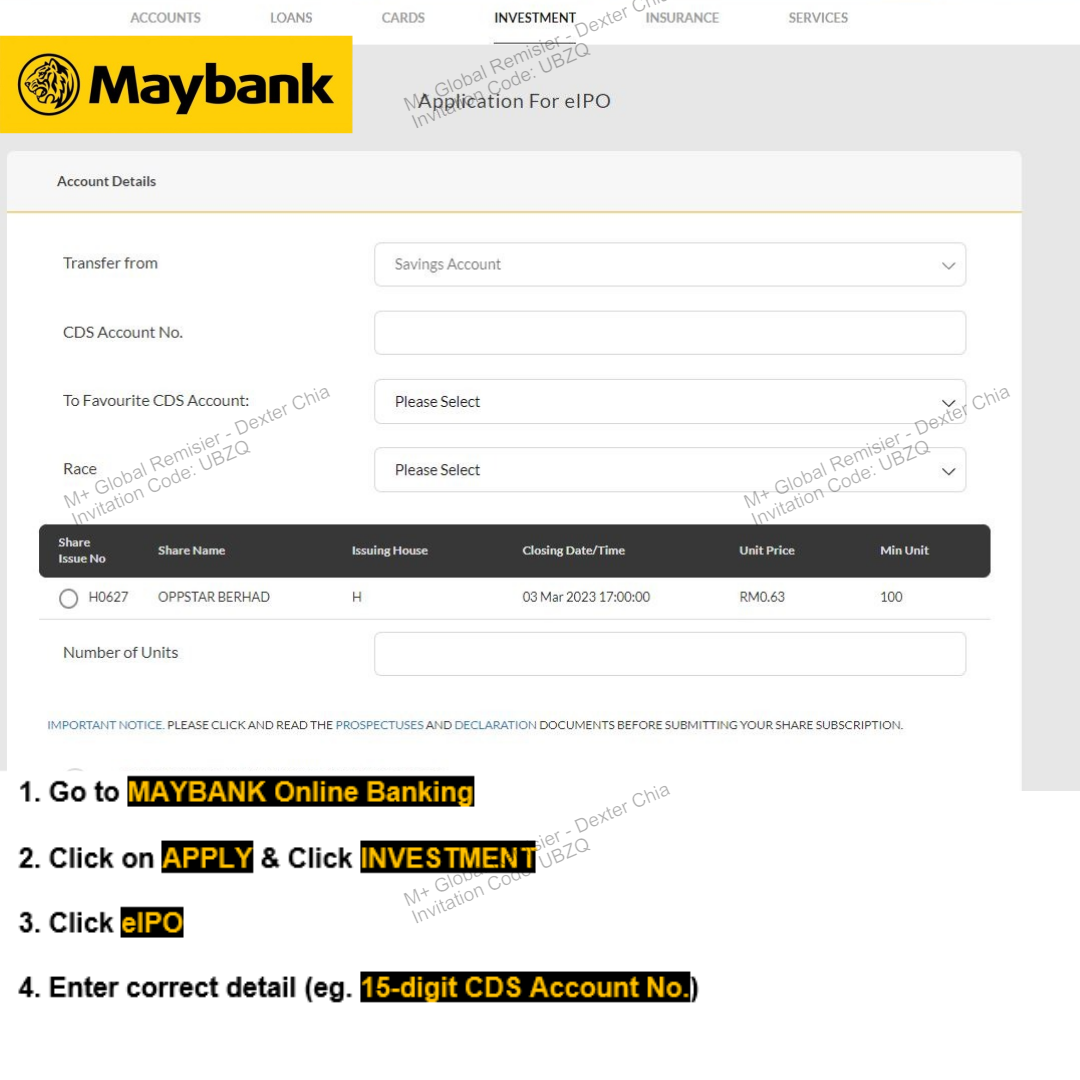

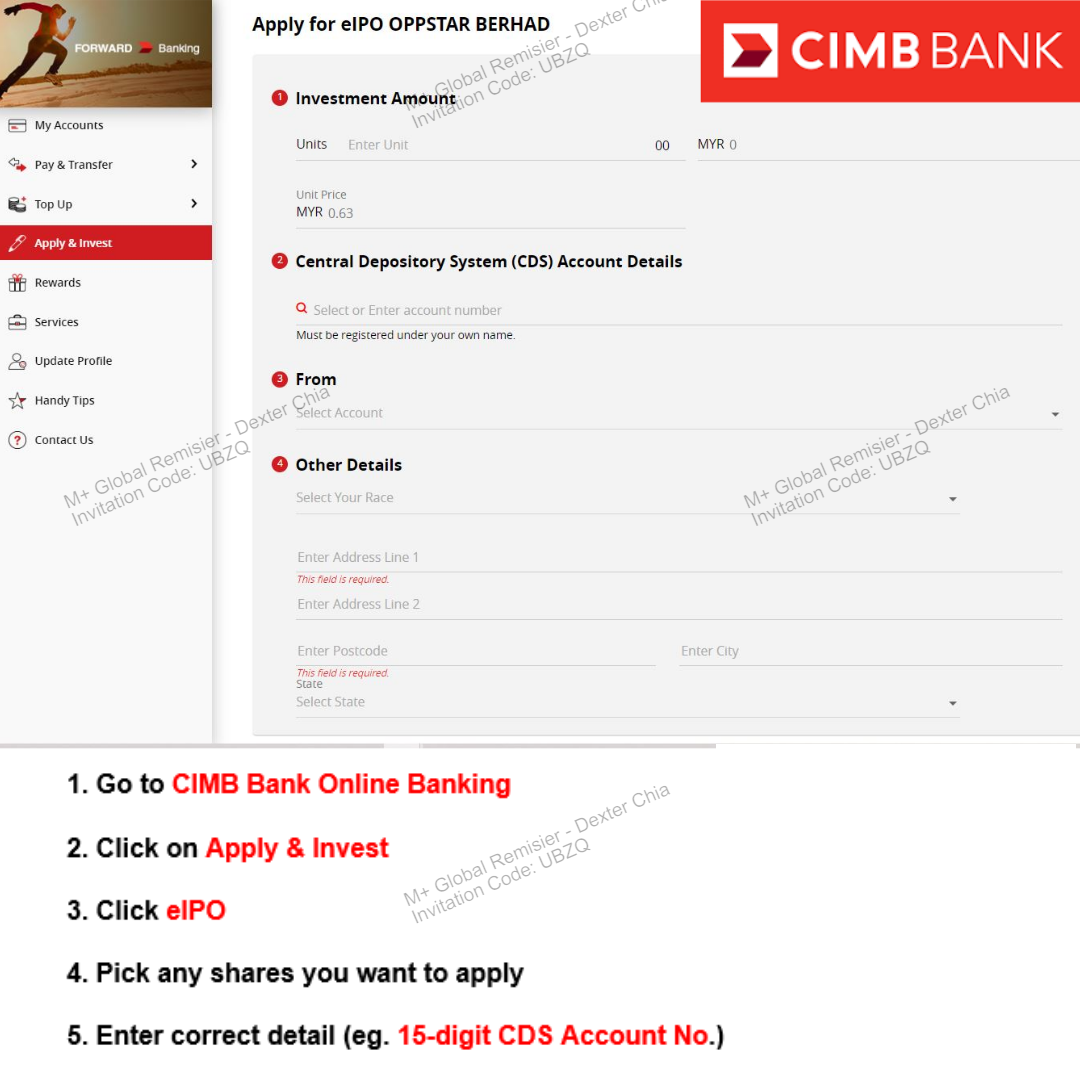

Do you know the Upper Limit for IPO First Day Trading may rise up to 400% (5 Times) ? But how do you apply for an IPO in Malaysia? In this beginner's guide, we'll take you through the steps and show you how to secure your allocation today. You can always check the IPO Summary at Bursa Malaysia Website. Step 1: Owning a Direct CDS Account In my previous blog post, <Step by Step: How to open a Direct CDS Account Online (Malaysia)> , I have shared the information on account opening steps, the benefit of owning a Direct CDS Account, the differences between Direct CDS and Nominee CDS Account, and etc. After that you shall remember your 15-digit CDS Account Number. If you're registered under M+ Online (Malacca Securities Sdn Bhd), you may check your CDS Account number at the M+ Online Website > My Account > My Profile. Your CDS Account Number shall start with : 012001XXXXXXXXX Step 2: Apply IPO using own Online Banking Account In this step, I will use CIMB Bank, Public Bank and Maybank Online Banking as examples. Eg: Applying for OPPSTAR BERHAD. 1. Go to your MBB/CIMB/PBB online banking. 2. Follow the steps in the photos. Step 3: Check IPO News & Results You may check the some IPO Press Releases here. 1. Tricor - TIIH Online 2. Malaysian Issuing House - MIIH Step 4: Check your Portfolio If you're lucky enough to get the IPO, you can see the IPO appears in your Portfolio during the listing day. Do contact your Remisier/Broker if you have any issues. Last but not least, Investing in IPOs in Malaysia can be a smart way to diversify your portfolio and potentially earn significant returns. By following the steps outlined in this guide, you can apply for an IPO easily.

0 Comments

Leave a Reply. |

Categories

All

|

|

Alternatively, you may WhatsApp me at +60169059789.

|

About MeAbout CompanyM+ OnlineM+ Global |

Why me?M+ Global FAQsBlog |