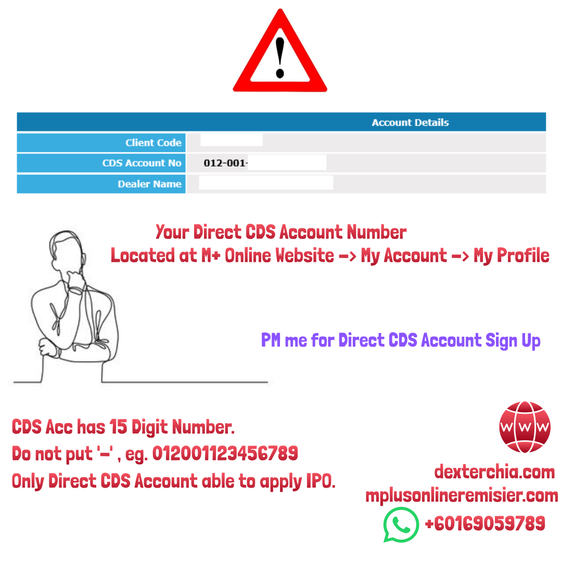

This blog post will discuss the number of ways to apply for IPO in Malaysia.  An Initial Public Offering, or IPO, is the first time a private company tries to "go public." In the actual process, a company that isn't on the stock market sells new or used shares that can be bought or sold by anyone, even current owners. Before it goes public, a company is private and has fewer shareholders. These shareholders are usually qualified investors, such as venture capitalists, angel investors, and wealthy individuals, as well as early investors, such as the people who started the business and their family and friends. After an IPO, the business is listed on a regulated stock market and can be bought and sold by anyone. An IPO is a big event in the life of a company. The main reason a company goes public is usually to get more money to grow or improve its business. Companies sometimes go public so that existing shareholders can get a return on their investment, so that employees can get stock options, or just so that the company's name, image, and reputation become more well known. Okay, so let's say you want to join an IPO. How do you do that? People are interested in IPOs Whether you are a new or experienced trader, you may have heard the terms "IPO" and "good returns" used together more than once. It's not a surprise that this is the case, since getting IPO shares in a promising private company is a good way to make money. If investors like a company's growth chances, its first public shares will likely be in high demand. This is especially true since IPOs are usually priced low to get them sold right away. So, it's not unusual for IPO shares to go up in value very quickly when they hit the stock market. This makes IPO shares "hot property" and always keeps investors interested in IPOs. Investors' trust in the government, including market managers, is another reason why IPOs are so popular. Investors can be sure that an initial public offering (IPO) is a good investment chance because it follows strict rules and goes through a thorough evaluation process before it goes public. When a company wants to go public, it has to go through a strict screening process and send a lot of complicated paperwork to the Securities Commission of Malaysia (SC) through the licencing bank. After that, the company's prospectus has to be carefully read by several reputable individuals. It includes information about the company's background, main business, management, finances, corporate strategy, number of shares and prices, expected dividends, risk, and other things. Applying for an IPO For the public investor, there are three ways to apply for an IPO – two traditional ways and an online way. However, before applying,the investor will need to ensure they have a Direct CDS account with Bursa Malaysia. It is important to thoroughly study the IPO by reading the prospectus of the company. A great deal of reliable information can also be found using resources like established newspapers and Bursa Malaysia''s website. An informed investor is more likely to be successful than a reckless investor. A preliminary point to note is that, under the law, you may make only one share application for an IPO. Submitting multiple applications is an offence under the Capital Markets and Services Act, 2007. 1. Use application forms to apply (white form) An IPO application form called the "White Application Form" is what people have used in the past to apply. This paper form is easy to find at financial institutions, stockbroking firms, and licensing houses. There are three important steps to the application:

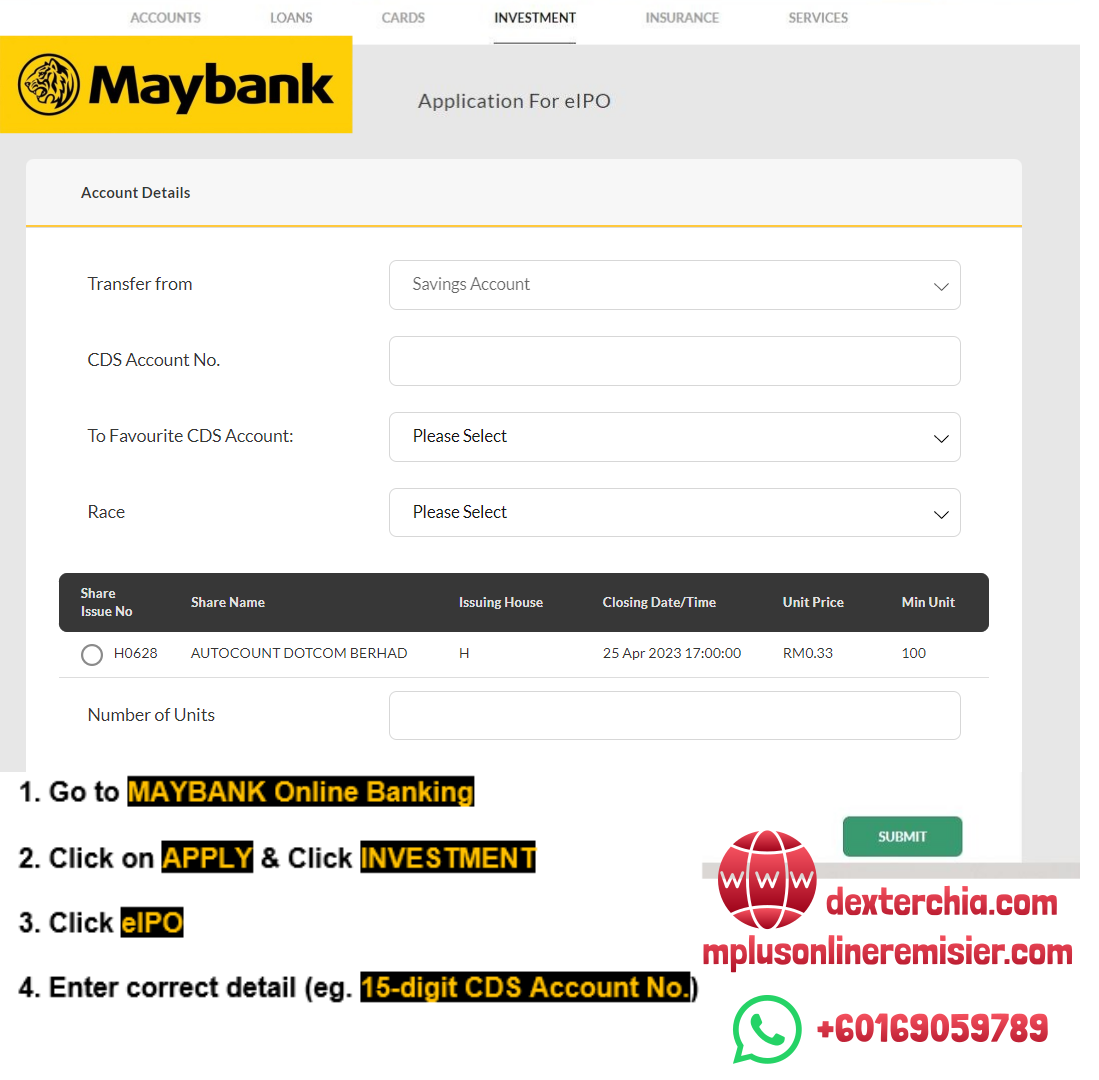

2. Use the Electronic Share Application (ESA) to apply. An Electronic Share Application (ESA) can also be sent through an ATM if you want to apply for an IPO. You need a savings account, an ATM card from a partner bank, and a Central Depository System (CDS) account in order to use the ESA feature at an ATM. A company called Bursa Malaysia Depository Sdn Bhd runs the CDS system. You can put your securities in a CDS account, which is like a digital locker, and add, remove, or transfer securities from or into it. Do what the ATM tells you to do. You will need the IPO stock code, your PIN, and your CDS account number. Once you've registered your application, don't forget to keep the printed ATM slip for your notes. 3. Using Online Banking Facilities (The MOST EASIEST WAY) The third way to get an IPO is to do it online. Different from the other two ways to apply, the online application is a relatively new idea. More and more small buyers are applying for an IPO from the comfort of their own homes. Maybank was the first bank in Malaysia to offer this online service in 2005. These days, this is something that most local banks give. Because each bank has its own rules and procedures, it is best to first ask your bank what the right way is to apply for an IPO and if there are any charges or fees. Other banks such as Public Bank and CIMB Bank also offer the IPO Subscription Service online. You must also meet certain requirements in order to fill out the online application. You must be a Malaysian national at least 18 years old and live in Malaysia. You must also have a Direct CDS account and not work for or be related to someone who works for the granting house. Also, the application must be for at least 100 IPO shares, or a number of such shares. Keeping your goal in mind.

When looking for an investment, it's always smart to be careful and use good judgment. This is also true for initial public offerings (IPOs). Things that look good or hopeful might not be when they are carefully looked at. You should do your study on the company and the industry it's in before applying for an IPO. You should also look at the future of both the company and the market as a whole.

0 Comments

Leave a Reply. |

Categories

All

|

|

Alternatively, you may WhatsApp me at +60169059789.

|

About MeAbout CompanyM+ OnlineM+ Global |

Why me?M+ Global FAQsBlog |