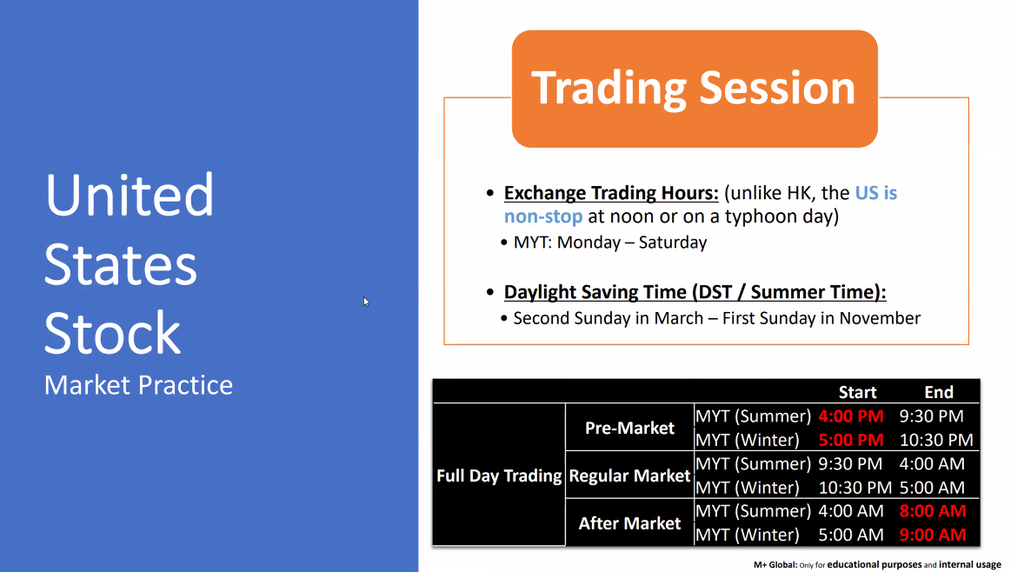

Do you know there are total of 3 types of trading hours in US Stock Market? In the dynamic world of stock trading, understanding the different types of trading hours can give you a significant edge. The US stock market operates beyond the traditional ‘9-to-5’ timeframe, offering additional opportunities for investors and traders alike. In this blog, we delve into the three types of trading hours that dominate the US stock market: pre-market, post-market, and regular trading hours. 1. Pre-market hours (4:00 AM - 9:30 AM Eastern Time) - offer a head start, enabling traders to react to overnight news and corporate announcements. During the pre-market hours, which occur before the official market opening, astute traders can gain a head start on the day's trading activities. This period allows investors to react to overnight news, corporate earnings announcements, and other relevant events that may impact stock prices. It is a time of increased volatility, as traders position themselves ahead of the regular session's opening bell. 2. Post-market hours (4:00 PM - 8:00 PM Eastern Time) - provide a chance to respond to news released after the market closes. On the other end of the spectrum, post-market hours present an intriguing opportunity for traders to react to news released after the market closes. These hours provide a chance to respond to earnings reports, economic data releases, and other market-moving events that occur outside regular trading hours. Engaging in post-market trading requires caution, as liquidity tends to be lower, leading to wider spreads and potentially heightened volatility. 3. Regular trading hours (9:30 AM - 4:00 PM Eastern Time) - are the most active, with high liquidity and numerous opportunities to buy and sell securities. The regular trading hours are the heart of the US stock market. This is the time when the majority of trading activity occurs and when market participants can execute trades with the highest level of liquidity. These hours provide ample opportunities for investors to buy and sell stocks, exchange-traded funds (ETFs), and other securities. It is crucial for traders to closely monitor market trends, news, and economic indicators during this period to make informed investment decisions. In the below photo, we have translated the time zone to GMT+8 Kuala Lumpur for easier viewing. In fact, our M+ Global APP allows user to trade during these hours! This is definitely our good competitive advantage if compared with other brokers. By harnessing the distinct characteristics of each trading session, investors can make informed decisions and optimize their trading strategies. Stay tuned for our upcoming series where we delve deeper into each session, sharing expert insights, strategies, and tips to navigate the US stock market with confidence and precision.

0 Comments

Leave a Reply. |

Categories

All

|

|

Alternatively, you may WhatsApp me at +60169059789.

|

About MeAbout CompanyM+ OnlineM+ Global |

Why me?M+ Global FAQsBlog |