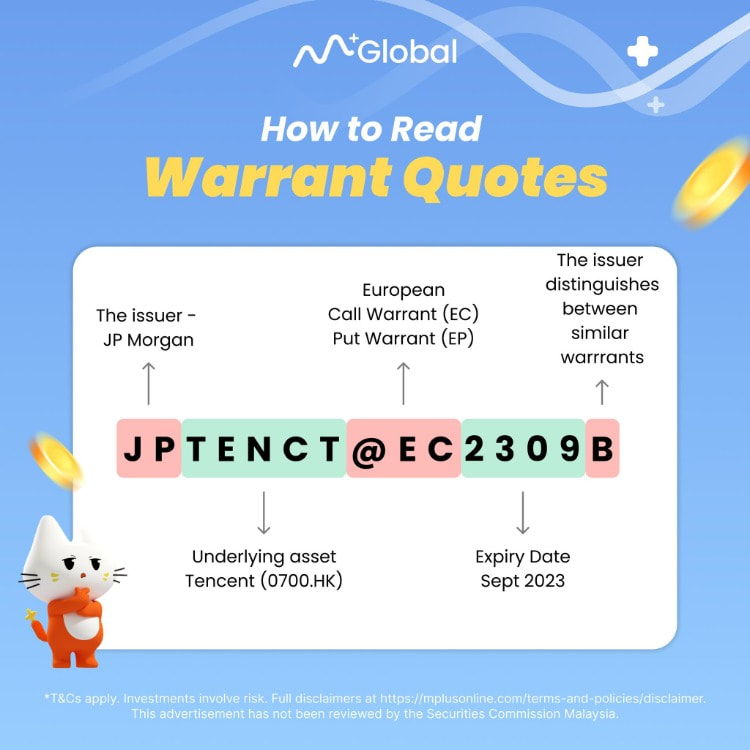

Understanding the 4 Key Factors that may affect the Warrant Prices! In the previous lesson, we delved into the world of Warrants & CBBCs (Introduction), exploring how to profit from trading them and the key differences between the Warrants and CBBCs. Today, we will go on diving deeper into the world of Warrants & CBBCs, exploring their features and using them to enhance your trading strategies. How to Pick the Right Warrants? When choosing a warrant, we suggest that investors consider the following 4 steps: Step 1: View on Underlying Share/Index Firstly, consider the market view on the underlying share/index and select call warrants for bullish views and put warrants for bearish views. Additionally, have a target price in mind to align the warrant selection with desired profit potential. Step 2: Timeframe Secondly, consider the timeframe and match it with the warrant's expiry date to manage risk and leverage. Step 3: Gearing Level Thirdly, evaluate the effective gearing level to understand how the warrant price moves relative to the underlying asset's price Step 4: Implied Volatility Finally, assess the implied volatility and prefer warrants with lower implied volatility, all other factors being equal. How to Read Warrant Quotes? 4 Key Factors Affecting the Warrant Price To discover how they can provide you with unique opportunities to maximize your returns and achieve your financial goals, You can watch this YouTube channel: M+ Online | Dexter Chia

0 Comments

Leave a Reply. |

Categories

All

|

|

Alternatively, you may WhatsApp me at +60169059789.

|

About MeAbout CompanyM+ OnlineM+ Global |

Why me?M+ Global FAQsBlog |