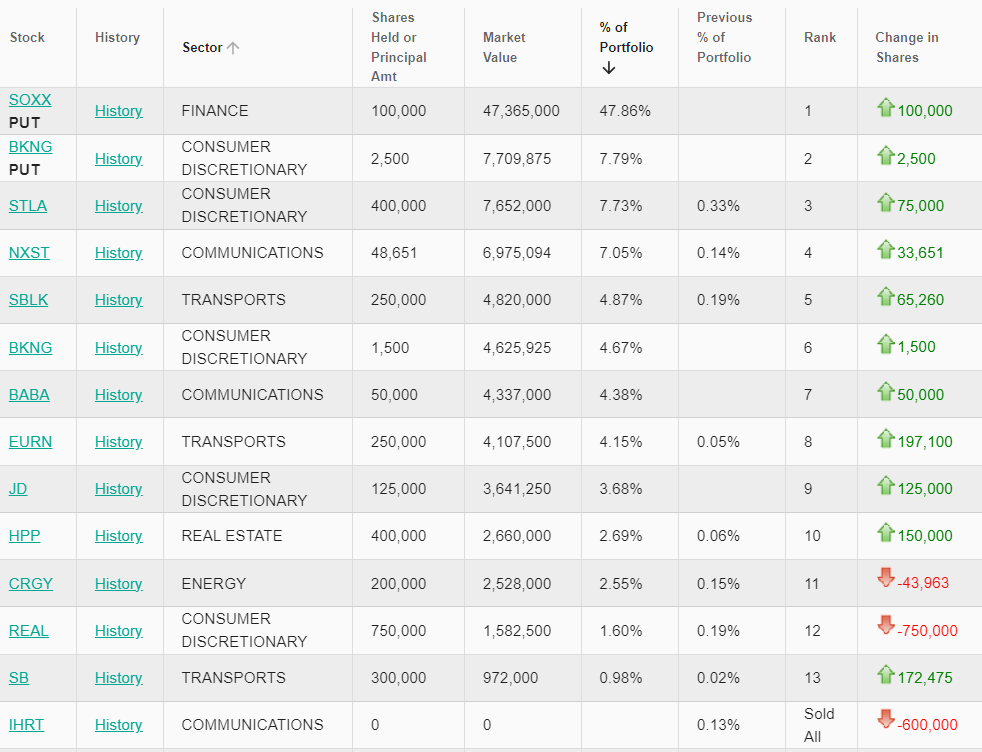

"The Big Short" hedge fund manager Micheal Burry, who famously shorted subprime mortgages during the 2008 financial crisis, started to short 100,000 shares of BlackRock's semiconductor ETF, the iShares Semiconductor ETF (SOXX), and another 2,500 shares betting against online travel website Booking Holdings Inc. (BKNG). Burry is the founder of Scion Asset Management, a private investment firm. His investment approach is often characterized by in-depth research, a focus on value investing, and a willingness to take contrarian positions based on his analysis of market trends. He is known for his intensive scrutiny of financial statements and economic indicators to identify investment opportunities that others might overlook. In recent years, Michael Burry has continued to attract attention for his views on the market and specific investment bets. According to a regulatory filing released on Tuesday, Michael Burry's investment firm, Scion Asset Management, concluded its bet against the S&P 500 and Nasdaq 100 indexes. As of the end of September, the firm shifted its focus to wagering against a selection of semiconductor stocks, which notably includes Nvidia Corp. Scion Capital broadly shrank its exposure to the stock market in the third quarter, according to its new SEC filing, selling 76% of the stocks it disclosed at the end of the second quarter. But Scion reopened long positions in JD.com and China-tech giant Alibaba (BABA) after selling out of the companies in the second quarter. In my previous post, we have discussed how to open a Foreign Stock Trading Account online in Malaysia.

0 Comments

Leave a Reply. |

Categories

All

|

|

Alternatively, you may WhatsApp me at +60169059789.

|

About MeAbout CompanyM+ OnlineM+ Global |

Why me?M+ Global FAQsBlog |